what is the sales tax on cars in south dakota

What is South Dakotas Wheel Tax. South Dakota has recent rate changes Thu.

All Vehicles Title Fees Registration South Dakota Department Of Revenue

South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price.

. For an additional 10-year period. The minimum combined 2022 sales tax rate for Aberdeen South Dakota is. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under.

Average Local State Sales Tax. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. All car sales in South Dakota are subject to the 4 statewide sales tax.

Maximum Local Sales Tax. The South Dakota sales tax rate is 4 as of 2022 with some cities and counties adding a local sales tax on top of the SD state sales tax. To calculate the sales tax on a car in South Dakota use this easy formula.

The highest sales tax is in Roslyn with a. The laws applicable in South Dakota allow a business person to include sales tax on the price of the products or services. With local taxes the total sales tax rate is between 4500 and 7500.

First multiply the price of the car by 4. This is the total of state county and city sales tax rates. South Dakota State Sales Tax.

The SD sales tax applicable to the sale of cars. Initiated in 1986 to help subsidize bridge and highway maintenance you pay the South Dakota wheel tax when you are registering your vehicle with. The sales tax was originally voted in by the public in November 2014 for a period of 10 years.

The base state sales tax rate in South Dakota is 45. That is the amount you will need to pay in sales tax on your. Farm and Ranch.

Maximum Possible Sales Tax. 31 rows The state sales tax rate in South Dakota is 4500. 39 minutes agoDakota Access.

Different areas have varying additional sales taxes as well. In addition for a car purchased in South Dakota there are other applicable fees including registration title and. Additionally South Dakota has a motor vehicle gross receipts tax of 45 percent that.

Find your South Dakota. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. What is the sales tax rate in Aberdeen South Dakota.

The vehicle is exempt from motor vehicle excise tax under. Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. Several examples of of items that exempt from South.

In South Dakota the sales and use tax rate is 45. In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Car Tax By State Usa Manual Car Sales Tax Calculator

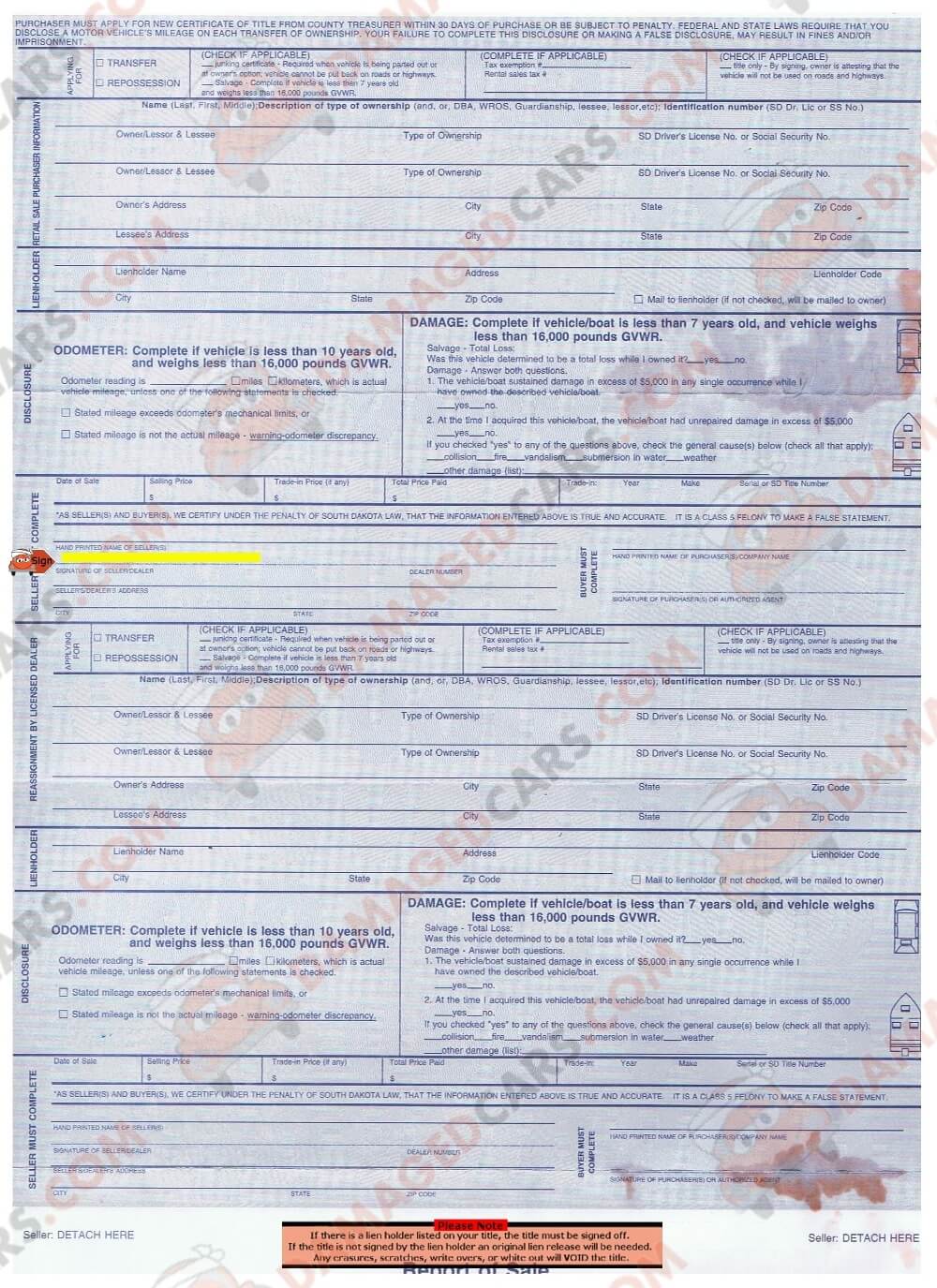

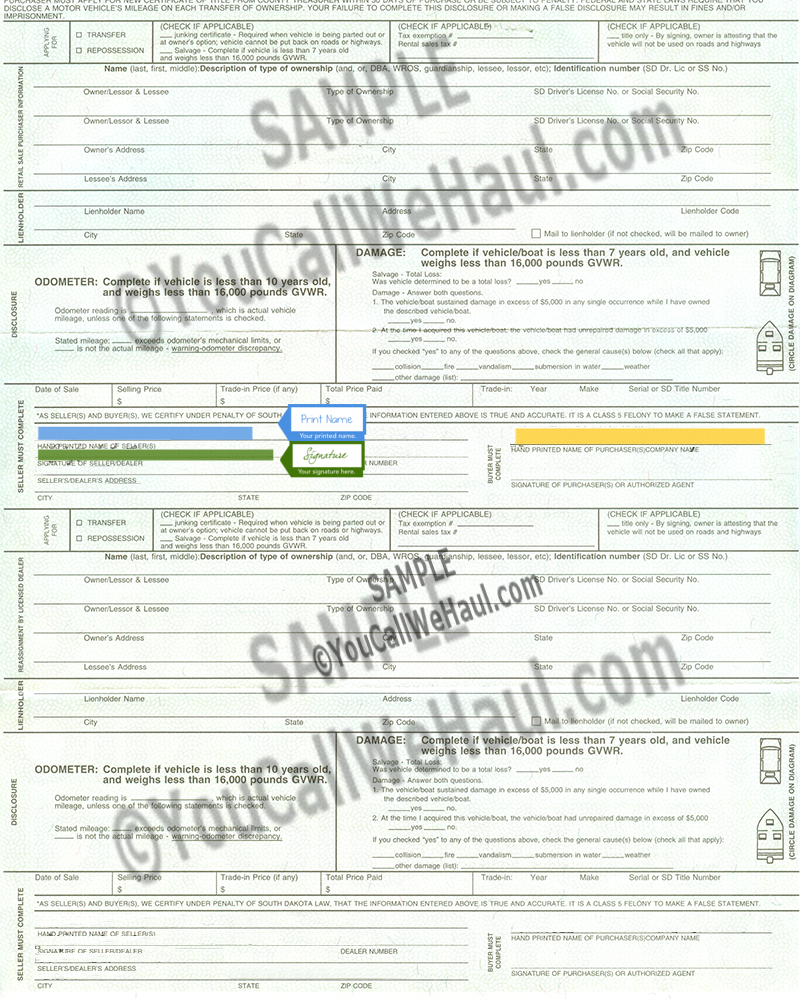

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

Sales Tax On Cars And Vehicles In South Dakota

Used Cars For Sale In Sioux Falls Sd Sioux Falls Ford Lincoln

Motor Vehicle South Dakota Department Of Revenue

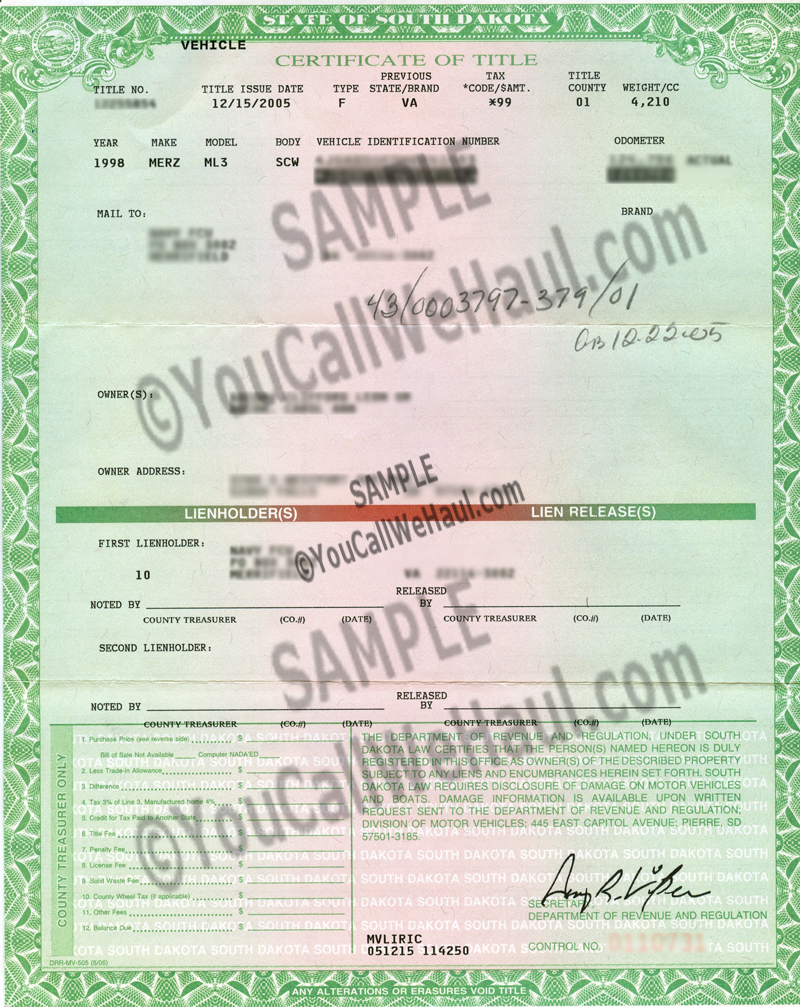

South Dakota Car Title How To Transfer A Vehicle Rebuilt Or Lost Titles

Historical South Dakota Tax Policy Information Ballotpedia

Individual Faqs South Dakota Department Of Revenue

How To Transfer South Dakota Title And Instructions For Filling Out Your Title

North Dakota Sales Tax Handbook 2022

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Transfer South Dakota Title And Instructions For Filling Out Your Title

South Dakota Title Transfer How To Sell A Car In South Dakota Quick

South Dakota Reports Spike In Sales Tax Growth In Report

How To Secure The Lowest Tax Rates On Your Next Car Carvana Blog

Sales Taxes In The United States Wikipedia

All Vehicles Title Fees Registration South Dakota Department Of Revenue

Bill Would Eliminate Missouri Sales Tax On Older Cheaper Cars Missouri Thecentersquare Com

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)