tax on unrealized gains bill

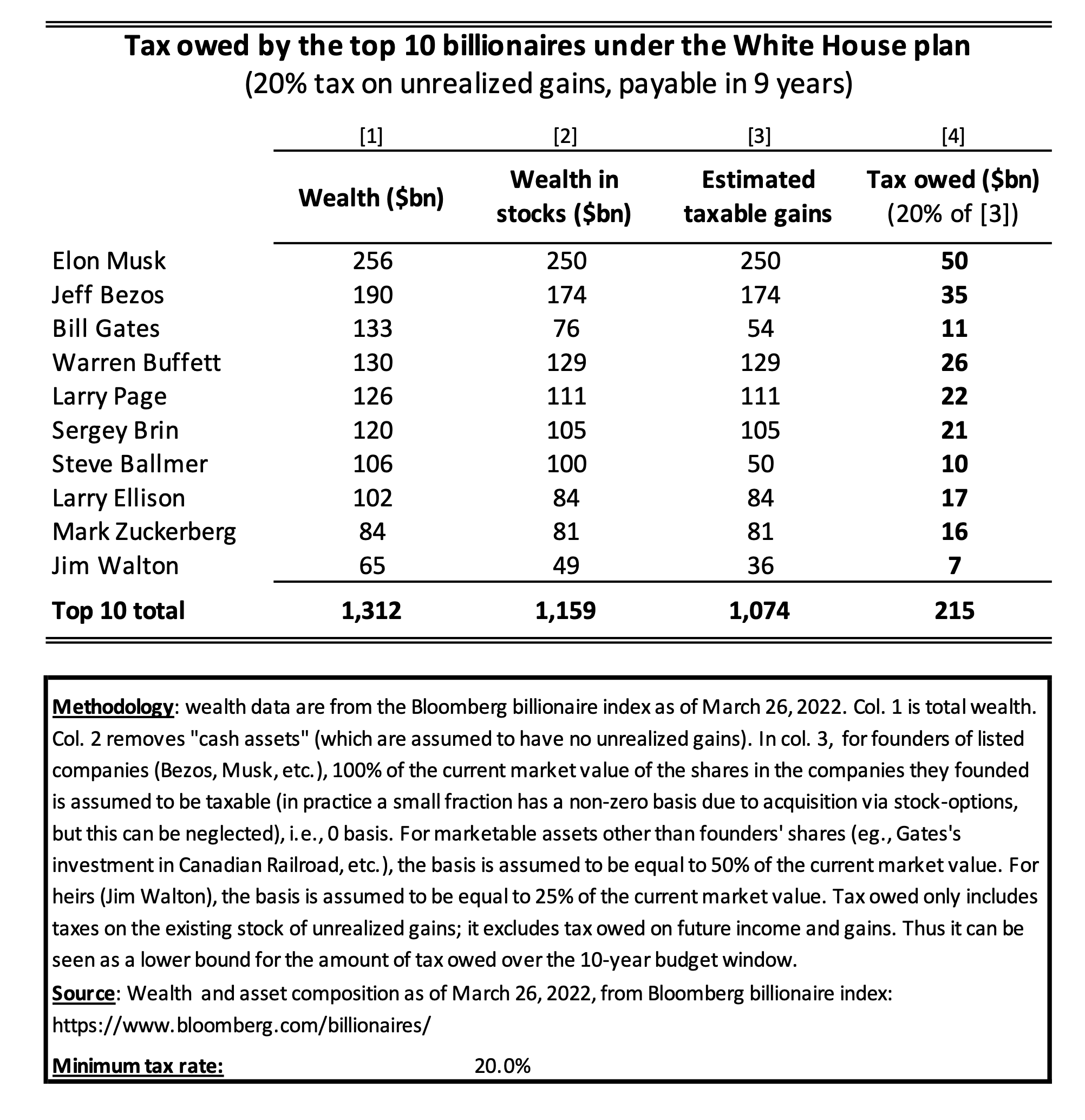

WASHINGTONPresident Biden expressed support for a proposal under consideration in the Senate to place an annual income tax on billionaires unrealized capital. President Biden on Monday unveiled a new minimum tax targeting billionaires as part of his 2023 budget request proposing a 20 rate that would hit both the income and.

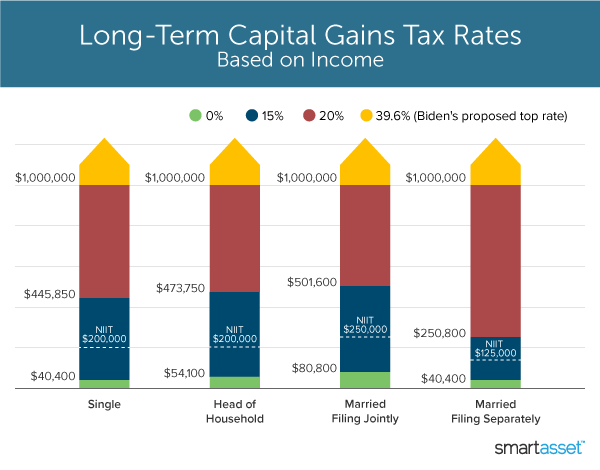

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

0000 0138.

. A proposal to tax unrealized gains is being considered in the Senate. President Bidens Fiscal Year 2023 budget includes a new tax on unrealized gains. Under the proposed Billionaire.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. WASHINGTONA new annual tax on billionaires unrealized capital gains is likely to be included to help pay for the. October 26 2021 619 AM PDT.

But one aspect of his proposal a minimum 20 tax on the unrealized gains of US. Short-term capital gains are taxed at the same rate as federal income taxes which can be up to 37 while the highest long-term capital gains tax rate is 20 but can be either 0. Households worth 100 million or more is drawing skepticism from tax experts.

She said she expected an agreement reflecting a consensus of all 50 senators on the tax and revenue portion of the bill. Billionaires and their growing piles of untaxed investment gains. The tax on unrealized gains faces hurdles.

Currently taxpayers pay tax only on realized capital gains in. Sarah SilbigerBloomberg via Getty Images. A tax on unrealized gains would punish taxpayers for past decision making by taxing paper gains from the original date that asset was acquired.

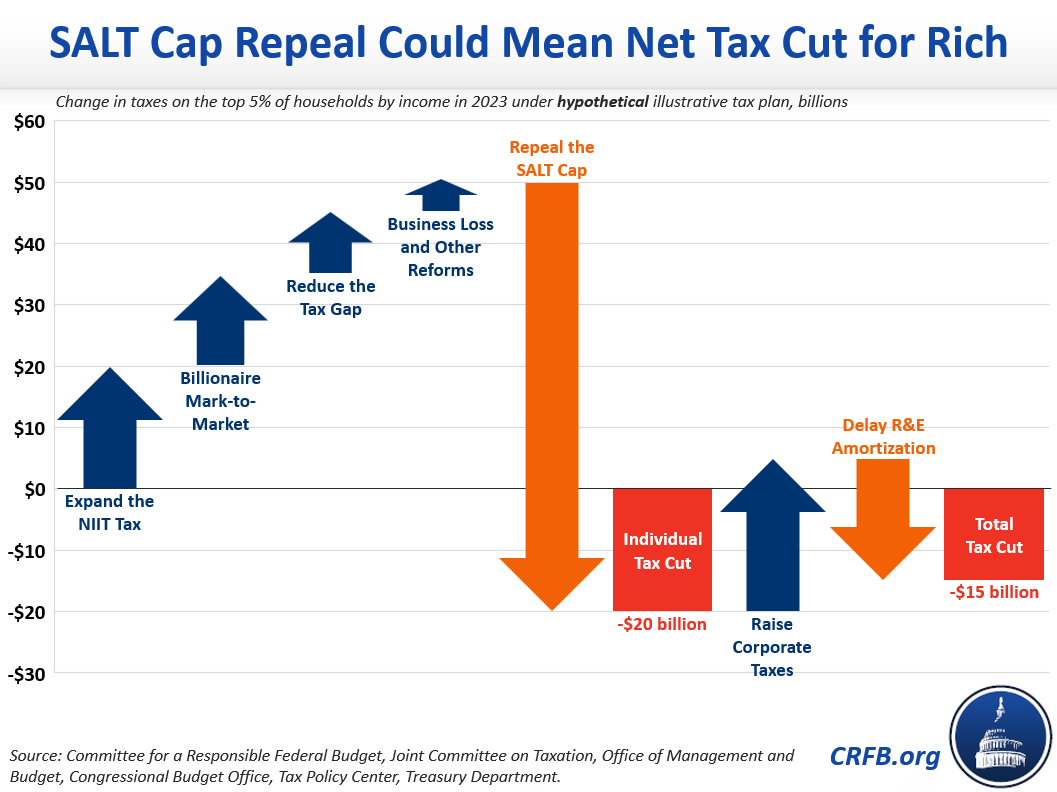

A proposed House Ways. Democratic leadership over the weekend began suggesting a new way to pay for President Bidens. How might it change the best investment.

The first of these is a proposal to implement a so-called mark-to-market regime for taxing unrealized capital gains. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. With their latest tax proposal Democrats are going after an elusive target.

This tax called a billionaire minimum income tax would impose an annual 20 percent tax on. A newly proposed annual tax on unrealized investment gains has been floated as a way to pay for the new 35T infrastructure bill. The impacted assets include stocks bonds real estate and art.

It would impose significant. Today On Point. This would eliminate wealthy individuals ability to defer taxation on assets.

The new unrealized capital gains tax would levy annual taxes on assets while they still have not been sold. To increase their effective tax rate. When the wealthiest families incur income taxes on capital gains they pay a top 238 federal tax rate on the transaction lower than the top 37 rate on income like wages.

Guests Steve Rosenthal senior fellow in the Urban-Brookings Tax Policy. This article is in your queue. October 25 2021.

Wealth taxation and the Biden administration targeting unrealized gains. President Bidens 2 trillion spending package continues to stall as senior Democrats are hoping to finalize a proposal on a new annual tax on billionaires unrealized.

Tax Strategies Using Nua For Modestly Appreciated Stock

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

The Coming Tax On Unrealized Capital Gains

I Chose This Image To Represent Management Operating Agreements This Image Displays That An External Management Compan Management Company Incentive Management

What S In Biden S Capital Gains Tax Plan Smartasset

Could Reconciliation Deliver A Tax Cut To The Rich Committee For A Responsible Federal Budget

Tax Advantages For Donor Advised Funds Nptrust

How Much Does A Comprehensive Financial Plan Actually Cost Https Www Kitces Com Blog Average Financial Plan Fee H How To Plan Financial Planning Financial

Taxing Unrealized Capital Gains A Bad Idea National Review

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Here It Is Wyden S Unrealized Capital Gains Tax On Wealthy Americans Swfi

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Bitcoin Gains Can Become Tax Free Investing In Cryptocurrency Cryptocurrency Bitcoin

The Unintended Consequences Of Taxing Unrealized Capital Gains

Quicken2017 New Features Ableton Live Investing Accounting Software

Biden S Better Plan To Tax The Rich Wsj

Gabriel Zucman On Twitter The Billionaire Well Technically Centi Millionaire Minimum Tax In Biden S Budget Is A Landmark Proposal It Would Ensure Billionaires Pay At Least 20 Of Their Income Including Unrealized Gains In Tax

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)