irs unemployment income tax refund status

In December 2021 the IRS sent the CP09 notice to individuals who did not claim the credit on their return but may now be eligible for it. Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund.

Tax Refund Timeline Here S When To Expect Yours

See How Long It Could Take Your 2021 Tax Refund.

. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your. Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 or 860-297-5962. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit.

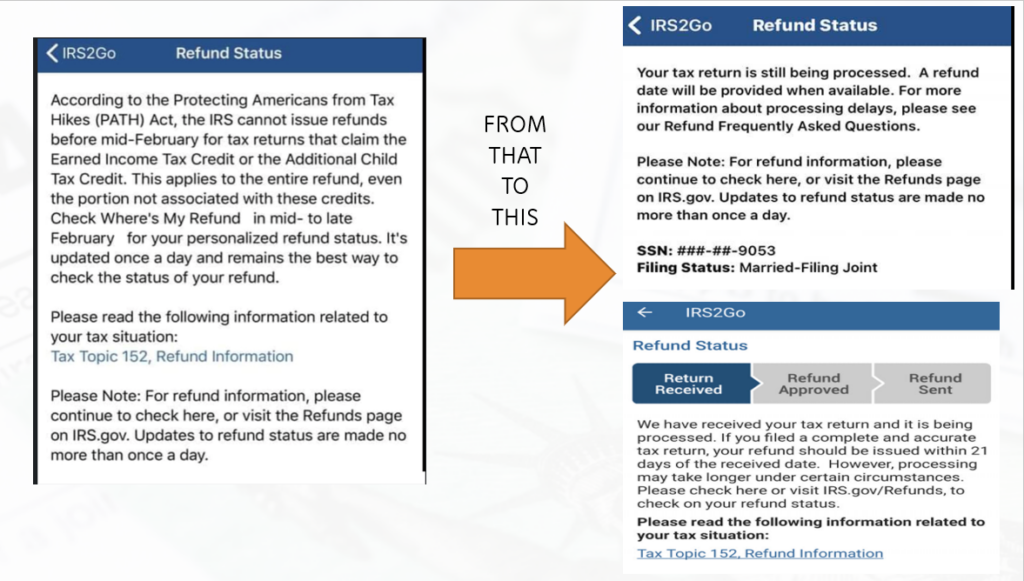

To report unemployment compensation on your 2021 tax return. September 13 2021. Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online.

Thats the same data. Irs unemployment tax break refund status Tuesday February 22 2022 The agency had sent. In the latest batch of refunds announced in November however the average was 1189.

The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in March. Since may the irs has issued more than 87 million unemployment compensation tax. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. You can call the IRS to check on the status of your refund. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF.

This is the fastest and easiest way to track your refund. However IRS live phone assistance is extremely limited at this time. Ad Learn How Long It Could Take Your 2021 Tax Refund.

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. To check the status of an amended return call us at 518-457-5149. People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release.

IR-2021-212 November 1 2021. One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected. The IRS has already sent out 87 million.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000. The 10200 is the amount of income exclusion for single filers not. Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break.

The Internal Revenue Service doesnt have a separate portal for checking the unemployment compensation tax refunds. The IRS has sent 87 million unemployment compensation refunds so far. Check For the Latest Updates and Resources Throughout The Tax Season.

Workers can exclude the. Its taking more than 21 days for IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review And in some cases this work could take 90 to 120 days. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

The systems are updated once every 24 hours. Because we made changes to your 2020 tax account to exclude up to 10200 of unemployment compensation you may be eligible for the Earned Income Credit. Attach Schedule 1 to your.

The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. What is status of my 2020 taxes refund for unemployment - Answered by a verified Tax Professional. The 10200 is the amount of income exclusion for single filers not the amount of the refund.

The IRS has sent 87 million unemployment compensation refunds so far. Check the status of your refund through an online tax account. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt.

My unemployment actually went to my turbo card. I just received a direct deposit tax refund IRS TREAS 310-TAX REF that does not match the amount of our 2020 refunds federal and state that we received. If you filed your tax return electronically by the April 18 deadline and are expecting a refund the IRS says you should expect it within 21.

Thats because the relief bill allowed 10200 of unemployment income to be collected tax free in 2020. One of the provisions in the plan was that taxes on up to 10200 in unemployment benefits would be waived for people earning less than 150000 a year. Check the status of your refund through an online tax account.

The IRS efforts to correct unemployment compensation overpayments will help most of the affected. Check your unemployment refund status by entering the following information to verify your identity. The update says that to date the IRS has issued more than 117 million of these special refunds totaling 144 billion.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state unemployment. Past-due federal tax debts State income tax obligations Past-due child and spousal support Federal agency debts such as a delinquent student loan and.

Another way is to check your tax transcript if you have an online account with the IRS. The agency had sent more than 117 million refunds worth 144 billion as of Nov. For the latest information on IRS refund processing see the IRS Operations Status page.

The IRS was supposed to refigure my taxes minus 10200 of unemployment income. Enter the amount of tax withheld from Form 1099-G Box 4 on line 25b of your Form 1040 or Form 1040-SR. WASHINGTON The Internal Revenue Service recently sent approximately 430000 refunds totaling more than 510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020.

Households waiting for unemployment tax refunds will be unhappy to know that 436000 returns are still stuck in the irs system. IR-2021-159 July 28 2021. 24 and runs through April 18.

Unemployment tax refund status. Youre eligible for the IRS tax refund if your household earned less than 150000 last year regardless of filing status. The Treasury Offset Program can use all or part of a refund to settle certain debts including.

Certain unemployment compensation owed to a state. ET The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

A Taxpayer S Guide To Filing An Income Tax Return In 2021 Micro Economics Economics Lessons Economics

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Heartbreaking Stories Emerge As Millions Await Tax Refunds Or Stimulus Payments From Irs Fingerlakes1 Com

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Tax Refund Irs The Motley Fool

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Tax Preparation Checklist Tax Preparation Income Tax Preparation Tax Prep

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer Abc7 New York

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Refund Tracker Why Is Your Tax Return Still Being Processed Marca

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Tax Season 2021 Starts Friday From Stimulus Checks To Unemployment Benefits Here S What You Need To Know Income Tax Federal Income Tax Irs Taxes

If You Fall Into Any Of These Categories You May Not Get Your Money Debt Taxes Tax Refund Tax Debt Child Support Payments

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refund Timeline Here S When To Expect Yours

Tax Return Status Why Is My Federal Refund Delayed Wthr Com

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca